Browse Your Medicare Choices: Medicare Advantage Plans Near Me

How to Pick the Right Medicare Benefit Plan for Your Needs

Browsing the complex landscape of Medicare Benefit plans can be a challenging job for numerous individuals looking for to make the ideal choice for their medical care needs. With a myriad of options readily available, each strategy comes with its unique collection of advantages, prices, and carrier networks that must be meticulously evaluated and considered. Recognizing exactly how to evaluate your certain medical care needs, understand the various strategy choices, and contrasting protection and expenses can be frustrating. With the best support and knowledge, making an informed choice that straightens with your requirements is not just possible but critical for guaranteeing detailed and tailored medical care insurance coverage.

Assessing Your Medical Care Needs

When thinking about a Medicare Benefit strategy, it is vital to very first examine your private medical care requires extensively. Understanding your current health status, expected clinical expenses, chosen health care companies, and prescription drug needs are necessary aspects in choosing the right plan. Start by reviewing your typical healthcare usage over the past year. Think about any kind of chronic problems that need regular medical interest or professionals. If you expect requiring certain therapies or surgeries in the coming year, guarantee that the plan you choose covers those services.

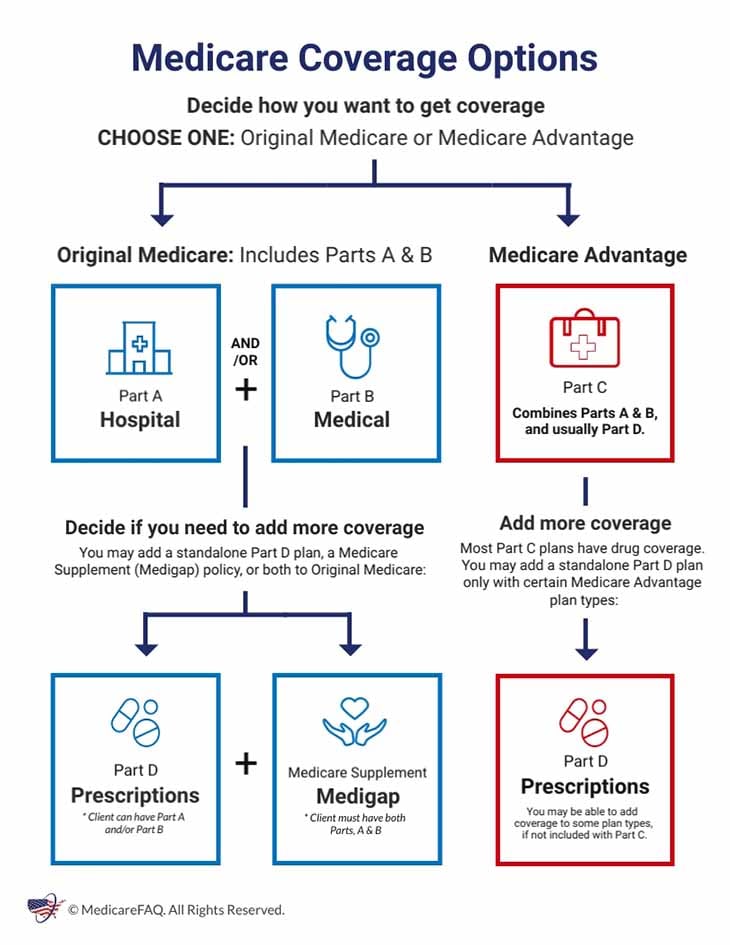

Understanding Plan Options

Contrasting Coverage and Expenses

In examining Medicare Advantage intends, it is vital to compare the coverage and expenses used by various strategy choices to make an educated choice tailored to your healthcare requirements and economic considerations view (Medicare advantage plans near me). When comparing protection, consider the services included in each plan, such as hospital stays, medical professional brows through, prescription medicines, and fringe benefits like vision or oral treatment. Analyze whether the strategies cover the particular medications you call for and if your preferred medical professionals and doctor are in-network

Just as important is assessing the expenses linked with each strategy. Understanding these prices can help you approximate your prospective healthcare expenditures under each plan.

Inevitably, selecting the right Medicare Benefit strategy involves striking a balance between thorough protection and workable prices. By meticulously comparing coverage and expenses, you can select a strategy that best satisfies your healthcare requires while straightening with your monetary restrictions.

Evaluating Carrier Networks

To make an informed choice when choosing a Medicare Advantage plan, it is important to review the service important source provider networks readily available under each strategy. Provider networks refer to the physicians, medical facilities, and various other healthcare carriers that have actually acquired with the Medicare Benefit plan to use solutions to its members. Keep in mind that out-of-network solutions may not be covered or may come with higher out-of-pocket expenses, so selecting a plan with a network that fulfills your requirements is important for optimizing the benefits of your Medicare Advantage protection.

Reviewing Fringe Benefits

When assessing Medicare Benefit plans, it is important to meticulously review the auxiliary advantages used beyond standard clinical insurance coverage. Medicare advantage plans near me. These additional benefits can differ commonly among different plans and can consist of services such as vision, dental, hearing, physical fitness programs, transportation to clinical appointments, and even insurance coverage for over-the-counter drugs

Before choosing a strategy, consider your specific medical care requires to determine which click this site extra advantages would be most useful to you. For instance, if you use glasses or call for oral work routinely, a plan that consists of vision and oral protection would certainly be advantageous. If you need assistance obtaining to clinical visits, a plan that offers transport solutions can be beneficial.

Reviewing the added benefits offered by Medicare Benefit strategies can help you select a plan that not only covers your fundamental medical requirements yet likewise provides added solutions that straighten with your medical care demands. By meticulously assessing these supplementary benefits, you can pick a plan that offers extensive coverage tailored to your details needs.

Verdict

Finally, choosing the proper Medicare Benefit plan requires cautious consideration of one's healthcare demands, plan options, insurance coverage, expenses, provider networks, and fringe benefits. By analyzing these factors extensively, people can make an educated decision that lines up with their specific requirements and preferences. It is vital to carry out comprehensive research and contrast different strategies to make sure the picked strategy will adequately fulfill one's health care demands.